Debate another run with MCWEF to a buck like it late December following more bullish news as the stock is placing greater emphasis on producing oil @ 28 bucks a barrel (Nearly half of what the BP's of the industry are doing).

"One of the very few oil companies with ability to make money on low oil consumer costs."

Has a history of jumping back at/above 1.00. Twice in last qtr 2014...Look for history to repeat in first half of 2015

We profiled MCWEF in latter part of 2014...stock ran from .similar levels to nearly a buck following....Then we discussed producing oil at half the cost of the majors.

In addition, we see recent, bullish company press releases driving right back to those levels with a little investor patience.

First, the news this week that sparked flexing:

| MCW Energy Group Projects a Windfall Reduction in Its Oil Sands Processing Costs Down to $ 28.00 USD Barrel as a Result of Slumping World Oil Prices at Marketwired Tue 9:30am est | ||

NBT Equities followed ucp with a reported that dove into the real specifics and what i

MCW's oil sands processing costs have now been projected downwards to $ 28.00 USD per barrel, mainly due to lower costs of the petroleum products being used in the extraction process, such as solvent blends, diesel fuel, liquefied propane, heating oil and natural gas condensates.

All of these energy/processing component prices have fallen in tandem with the current dramatic fall in world oil prices. Condensate prices are down 50%. Solvent blend, diesel fuel and propane prices are down an average of 40%.

"Unlike the high production costs and lower energy efficiency levels associated with the mega oil sands projects in Alberta, MCW is in a unique position to take advantage of this unexpected ....

Key Point: At @$28 CAPEX/OPEX cost per barrel of light sweet crude oil (@32 API) for MCWEF vs. $40-$60 per barrel processing costs for much of the Canadian oil sands heavy crude production (which also sells at 20-30% discount to WTI crude oil due to higher transportation and processing costs) and/or recently developed shale oil resources, we estimate MCW's Utah per barrel oil production is more profitable than 95% of shale oil being produced and virtually 100% of existing oil sands production.

Really Key Point: With their 5000 barrel a day production coming on line in 2016/2017…investors have to use 2016 WTI futures pricing (currently $62.72) to come up with cash flow forecasts. In addition, MCWEF's 5000 barrel a day plant plan includes the purchase of the Temple Mountain oil sands lease as part of the plant development project.

We estimate.... Read more: http://www.nbtequitiesresearch.com/report/mcw-energy-group-mcwef-projects-windfall-reduction-in-oil-sands-costs-to-28-per-barrel

MCW Energy Group Limited (MCWEF)

-Other OTC| Day's Range: | 0.6050 - 0.6810 |

|---|---|

| 52wk Range: | 0.44 - 1.52 |

| Volume: | 59,512 |

| Avg Vol (3m): | 39,664 |

| Market Cap: | 29.89M |

| MCW Energy Group Details Further Progress of Its Initial Oil Sands Extraction Plant in Utah at Marketwired Mon 9:30am | ||

- CBS Money Watch Article Lauds MCW Energy Group's Breakthrough Oil Sands Extraction Technology & MCW Announces Participation in LD Micro Conference, Los Angeles, December 2nd - 4th, 2014Marketwired(Tue, Nov 25)

- 'MCW Energy Group's Projected Oil Sands Extraction Production Costs Compare Favourably to Alberta Oil Sands' Average,' According to Bloomberg's Business Week ArticleMarketwired(Thu, Nov 20)

- Breakthrough Technology in Utah to Make Oil Sands CleanAccesswire(Thu, Nov 20)

- Sky Is The Limit For New Utah Oil Sands TechAccesswire(Wed, Oct 22)

- MCW Energy Group's Initial Oil Sands Extraction Plant Now Poised for Production; Chairman Announces Phase #2 Expansion Plan Including 5,000 Barrel/Day (Est.) Plant in Ashpalt Ridge, UtahMarketwired(Thu, Oct 9)

- MCW Energy Group Successfully Demonstrates Its Proprietary Oil Sands Extraction Technology in Vernal, Utah, Moves Forward With Required Procedures Prior to ProductionMarketwired(Tue, Oct 7)

- MCW Energy Group Announces Shares for Debt TransactionsMarketwired(Fri, Oct 3)

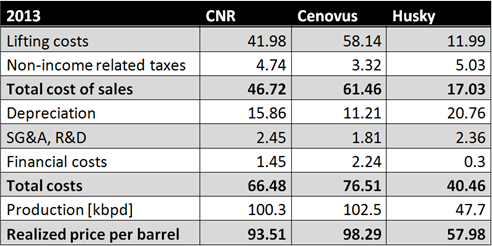

To understand the true value of MCW Energy Group's technology with production of oil from Utah Oil Sands, take a look at this "total cost of oil production" analysis from Seeking Alpha.

The results can be found in the table below:

CNR and Cenovus upgrade their oil sands to conventional grade oil levels with expensive upgrading. Husky sells straight heavy oil/bitumen at much lower prices.

KEY POINT: With @$30 total oil production costs and premium to WTI oil coming out of MCWEF's oil sands recovery plant in Vernal Utah, it profit per barrel of MCWEF vs. CNR or Cenovus is no contest—MCWEF wins by 100-120% MORE profit per barrel of oil.

To see the complete report, click here.

© Copyright Greenbackers.com Inc 2015

All Rights Reserved

Greenbackers.com is a service mark of Greenbackers

No comments:

Post a Comment