| SearchCore Announces Open Letter From Our CEO at GlobeNewswire Mon 8:00am | ||

For full report: http://bit.ly/1y9GPVZ

Notice ORGS sluggish rebuilding since runup to a buck back late august......Making a case for trending back to it with a little patience..

How to Read the Relative Strength Index (RSI) Technical Indicator - #pennystocks http://bit.ly/1enKkdW

Even With Apple Watch Delayed, I'm Raising My AAPL Price Target To $165 by Alex Cho

Forget Cyber Monday, It's Cyber Week - Forbes

Shared by

Shared by

Summary

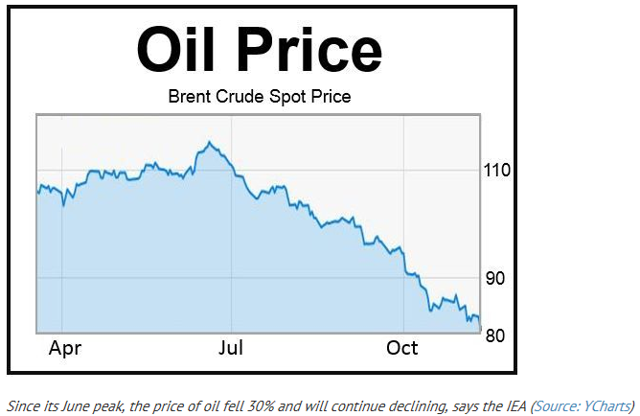

- Oil prices have plummeted about 30% in recent months.

- The crash in prices have dragged down the share prices of some of the largest companies on Earth, with seemingly no end in sight.

- I want to avoid falling knives but I want to catch lightning in a bottle.

I love the fact that I can pull up to a gas pump and now pay less than $3.00 per gallon to fill my gasoline sipping Ford (NYSE:F) C-Max, which gets about 39 miles per gallon already. The extra money saved can be plowed right back into either my savings or into the economy to help increase the GDP of the nation, create jobs, and help pay for many of the social programs that our government has seen fit to hand out to nearly everyone.

Unfortunately, I do not believe for a split second that the dramatic drop in oil prices is the new reality and we have all been saved by cheap energy. What I DO believe is that this "crash" has opened one of the most compelling opportunities of 2015 and beyond for investors, especially dividend growth investors.

In What Direction Do The "Experts" See Oil Prices Going?

T.Boone Pickens said not very long ago:

"If you don't think we'll see $200.00 to $300.00 oil .......... you are kidding yourself".

Why would someone who has himself invested heavily in renewable energy resources like wind, as well as an enormous amount in natural gas, be saying something like this when just about every projection looks like this:

There seems to be no let up in the decline either, and the USA continues to "drill baby drill". It is widely assumed that even the Keystone Pipeline will be approved by the US government, which will add even more of a glut of cheap oil into not only North America, but around the globe if the exportationrestrictions are lifted, as I believe they will be.

This is what we hear and read:

The oil price decline that started in June this year is set to continue, warns the Paris-based International Energy Agency (IEA), in its latest oil market report.

The energy watchdog said on Friday that according to supply and demand balances "the price rout has yet to run its course." In fact, the IEA says that further downward pressure in the first half of 2015 is highly likely.

Even the world's second largest oil producer (Russia), is warning whoever will listen that there will "definitely" be a collapse in oil prices that could ruin the global economy. At the same time OPEC is not planning on cutting itsproduction very much, if at all, either.

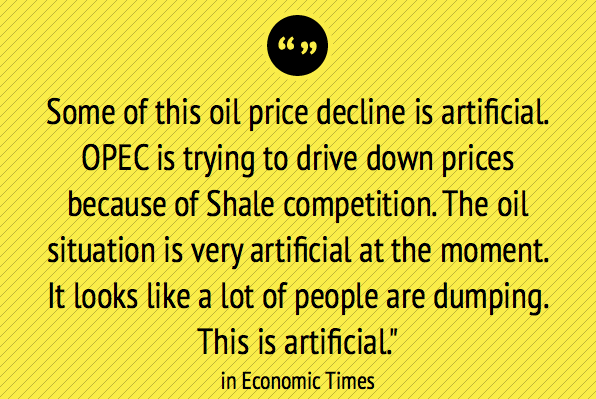

The constant drumbeat of further decline in oil prices is spoken about virtually every day, by every talking head that covers the oil industry. As far as I am concerned that is the first (and perhaps the best) signal that falling oil and gasoline prices just might be short-lived, and perhaps even "artificial" as Jim Rogers has said recently in "Economic Times":

A case could be made against the opinion of Rogers of course, however I recall in the early 1970s that the increase in oil prices was being "artificially" created by OPEC, and that oil tankers were kept from docking at ports just to keep the price of gasoline going up, in the interest of the big oil companies of course.

After we saw the unbelievable lines of American-made gas-guzzling cars to fill up, and people could only buy gas on odd or even days depending upon their license plate numbers, the world has been talking about peak oil. We will eventually run out.

Has the world gone mad, or have we figured out that we can continue drilling forever and never run out of fossil fuel? Think about it for just one moment.

There is nothing on the face of this planet that is being manufactured that is not oil based. Forget about the use of oil for gasoline for a second, and just think of every product we buy, wear, eat, package, steer, grow, speak into, listen to, or look at, that does not use oil in some shape or form. Add to that the use of oil as the main source of energy needed to make the products that are produced with oil, and the emerging markets that will need more energy in the form of oil for as long as we could possibly envision.

The IEA is now stating that further price declines in 2015 can be projected, but what about this chart from the very same agency, not that long ago:

Which projection is the most likely to occur? Continued lower prices, or an eventual end of the drop and a gradual increase once again? The answer is simple, to me at least: It is all about supply and demand.

My Thesis

Would Exxon Mobil (NYSE:XOM) and Chevron (NYSE:CVX) continue to pour more and more money into retrieving and refining oil if the demand was to become so low that these enormous companies would go broke? Is the worldreally ready to rely on solar, wind, natural gas, and nuclear to supply the energy needs to do and make just about everything on this Earth? If you are someone who actually believes this, then I will borrow T. Boone Pickens' words and simply say, "you are kidding yourself".

The entire landscape of oil prices can change as quickly as the seasons do. Probably even faster if the big oil companies turn off the equipment. As far as I am concerned the price of oil is as manipulated as much as our money supply. The very reason for the drop in demand and the increase in supply could actually fuel an even greater spike in oil prices, sooner than later.

Yes, the price drop has only just occurred, and, of course, we can't expect that it will have an immediate effect on consumption. But, increased consumption would likely take the oil markets back above $100 per barrel since small changes in supply and demand tend to move the oil price sharply. At the $100 level no one would be calling the situation a glut.

Indeed, just my opinion of course, but what better way for the politicos to show a stronger economy, healthier consumers, greater job growth, greater mega corporate earnings and eventually higher wages? By the way, this has nothing to do with any political party because the dynamics of the landscape can be argued by having both political parties taking credit.

- "Drill baby drill" efforts from the right, which is increasing supply.

- From the left and the current administration, the reduced reliance on oil and the dollars spent on alternative energy sources.

Take your pick, I believe we will hear plenty about both from each side. Toss in the Keystone pipeline, energy exportation restrictions, and climate change, and we have enough debate fodder for the next 2 years.

Actions I Will Take

So what all of this means is that I believe buying shares of the largest energy companies, right now and if the share prices continue to drop, will offer the shareholder increased value over the long term (18-36 months) and will increase a dividend investor's income just by adding shares of any of these companies.

While I already own Exxon Mobil (XOM) and Chevron (CVX), another company that is also a mega cap dividend champion is looking very cheap right now:ConocoPhillips (NYSE:COP).

The basic fundamentals are compelling enough:

- The current share price of $71.41 is right in the middle of my own personal"buy" target.

- A current dividend yield of 4.10% is very strong incentive to own shares now.

- Increased dividends in the last 13 consecutive years with an average increase of 15% (roughly) per year.

- A comparatively low payout ratio of 37%.

- Price to book value of just 1.57.

- An enterprise value of $103 billion with a current market cap of $88 billion.

- PE ratio of 9.47.

- 46% gross margins, 23% operating margins.

- 67% of all outstanding shares are held by institutions.

Add to this the share price deterioration over the last several months:

Based upon my opinion and thesis, COP is a bargain right now, and given the fact that its dividend is strong enough to further insulate investors from long-term risks, a balanced portfolio of dividend growth champion stocks can absorb another energy stock in addition to XOM and CVX.

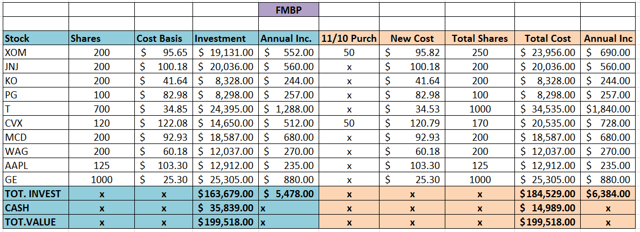

I will be adding shares of COP to the FMBP over the next few days. Here is the updated chart showing my recent purchases of both XOM and CVX:

New readers can follow this portfolio from the beginning by reading this article.

Disclaimer: The opinions of the author are not recommendations to either buy or sell any security. Please remember to do your own research prior to making any investment decisions.

Additional disclosure: I will be buying shares of COP later this week.

No comments:

Post a Comment